Teranga Capital is a private company under Senegalese law created in 2016 by entrepreneurs and private actors. First impact fund in Senegal and in Gambia, Teranga Capital belongs to a pioneering network in impact investment, entirely dedicated to the financing and support of start-ups and small and medium-sized enterprises (SMEs) in Sub-Saharan Africa.

Provide the means for Senegalese and Gambian entrepreneurs to carry on their growth projects

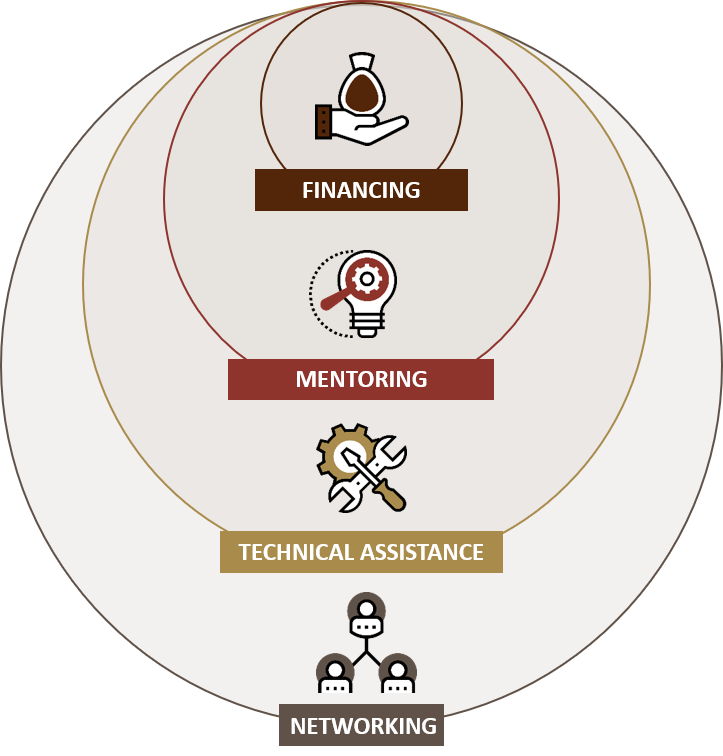

Bring funding and strategic support

Entrepreneurial spirit, commitment to development, integrity, commitment to excellence

We are persuaded that companies have an essential social role in the real economy.

In addition to the extra-financial activities, Teranga Capital is a committed player in Environmental, Social and Governance (ESG) criteria.

One of our objectives is also to promote the social and environmental responsibility of the company and build with the entrepreneur an action plan to boost the impacts on each of its stakeholders (employees, customers, local communities, suppliers…), referring to the framework established by the United Nations with the Sustainable Development Goals.